Hospitals in Emerging Asia are expected to see a challenge with cash flows in the next 2-4 years. As seen post-SARS, outpatient and ambulatory services could only be back to usual levels in 3-4 years. Given evolutionary phase, Telemedicine will not fully compensate. Adding pressure to cash cycles are slow payments by universal coverage, mounted by reduction in elective surgeries. Hospitals will have to deploy a multitude of options to address cash flow challenges.

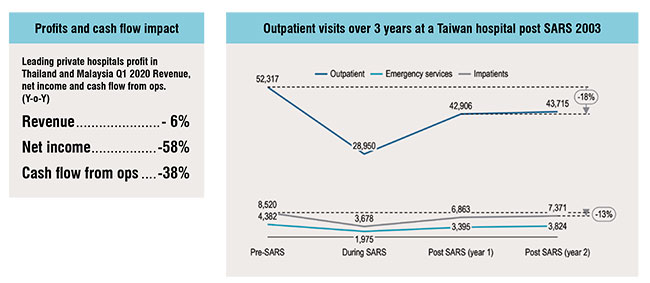

As markets in Asia-Pacific gradually reopen and a sense of normalcy returns, various analysts expect private hospitals to have a strong performance from second half of 2020 relying on pent up demand of patients for elective and chronic treatments. However, drawing from lessons of SARS 2003, and per conversations with hospital leaders, the path to recovery is likely to be uneven and might be painful financially. Hospitals need to navigate this difficult time with deft cash flow and resource management.

During the pandemic's first wave at its peak: hospitals have been overburdened, ICU's crowded, while hospital rooms quiet. Excessive demand for critical care, need for enough medical supply and PPE, staff shortage, put severe cost / Opex pressures.

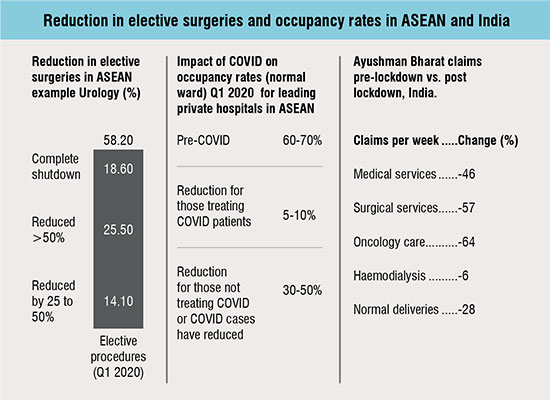

At the same time, elective procedures reduced drastically driven by government directives and reprioritisation of cases plus, modalities of outpatient services wereeither strongly modified (e.g. moved to online consultant) or completely shut down. Initially as the pandemic unfolded, patient volumes were buffered by COVID-19 inpatients, and reimbursements offered in some markets. However, markets like Thailand, Vietnam and lately, Malaysia and Singapore that have managed to control the pandemic better saw fewer patients with COVID-19, exposing private hospitals to the challenge of improving occupancy rates. (Figure 01)

The drivers of lower profits and cash flow range from a reduction in most profitable treatments to a complete decline in medical tourism usually forming 10-15 per cent of the revenues but about 20-25 per cent of the profit

While various surveys had predicted afull recovery of elective procedures in markets like Thailand and China by end of May-June, the overall number of elective procedures is not rising as fast as expected: per recent analyst reports of healthcare groups and suppliers with major operations in China, elective surgeries are back to ~50 per cent volume. For example, Aoxin Q&M, a leading dental chain, has already advised of a weak recovery in sight for this year's operations.

Hospitals in Thailand too are not back to full potential: a case in point, Bumrungrad Hospital reported weak Q1 2020 earnings but might have a worse Q2 2020 per DBS group estimates. In order to boost demand, hospitals in Thailand have started offering promotional packages: buy one physical check-up and get one free. Some of the mid-tier hospitals are expected to report a revenue decline by 7 to 10 per cent. In Malaysia, one of the leading private hospital groups, KPJ, too has warned of a weak Q2, 2020.

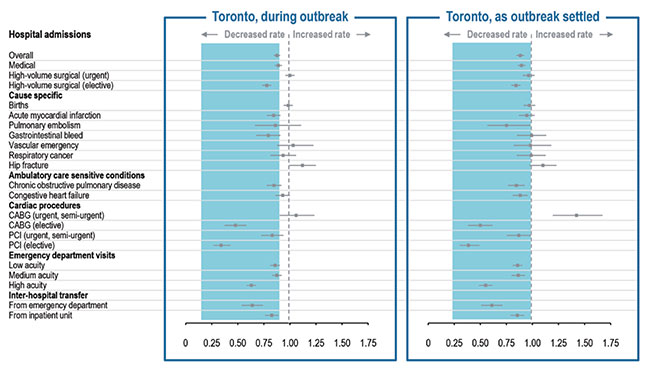

These trends, while underwhelming, are not different from how patient visits evolved during SARS. Studies which tracked hospital performance post-SARS in the two most affected cities, Taipei and Toronto, suggest that outpatient visits were only back to full capacity in year 3 of the outbreak and elective procedures also took about 15-32 months to come back to usual levels.

The challenge in the case of COVID-19 is further exacerbated by the possibility of second wave of cases after economies re-open which shall only further slowdown recovery for hospitals.

Telemedicine's adoption is a boost for the healthcare sector, however guidelines, business models and reimbursement models are evolving. Telemedicine helps hospitals provide a viable engagement model, but two key uncertainties remain: whether the relatively relaxed guidelines shall persist, and if the adoption would sustain. Most likely, while the overall levels of telemedicine usage would be substantially higher than pre COVID-19 levels, the sustainability would vary from market to market. Singapore, China, and Malaysia are expected to lead while Indonesia, Japan, and Thailand shall remain close followers. Given the dependence on a physical set-up for a procedure and the varying adoption levels across markets and demographics, telemed volumes and payments are less likely to fill the gap with lower outpatient visits.

In the past 4-5 years, universal coverage in Asia-Pacific has been a mega trend: from BPJS in Indonesia to Ayushman Bharat in India and coverage levels increasing in Vietnam and the Philippines. Private hospitals which were so far being selective in case mix and participation of universal coverage are likely to see a larger portion of revenues in the interim through the reimbursed programs.

Three reasons driving this shift are:

i) The reduction in cash patients as patients continue to be reluctant on elective visits, plus lower medical tourism, both from within and outside the country;

ii) increased reimbursements: lately, SSS in Thailand had 7+ per cent increase in reimbursements, BPJS premiums are rising at least for the formal group and reimbursement rates are expected to rise at least for a few services. Case in point, COVID-19 outpatient reimbursements are better than the usual INA-CBG class A rates in Indonesia; similarly Ayushman Bharat included cancer coverage in late 2019;

iii) The expected second wave of COVID-19 cases.

The challenge with most coverage schemes in the region though has been budget shortages and, as a result, slow payment cycles, which have already put pressures on hospitals’ working capital.

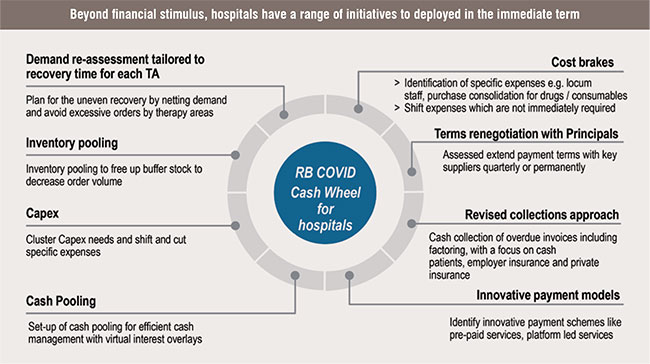

Hospital groups recognise the need for cash management to be prioritised and it can be seen in the strong advocacy for financial stimulus. However, beyond relying on an already pressured healthcare and stimulus budget, and to brace for a longer road to recovery, hospitals can deploy a range of options. At the outset, we expect that most CFOs have already set up a 13-week cash flow assessment cycle; it’s a hygiene practice in the current scenario. Below are some initiatives that can be deployed and monitored in the immediate term:

Demand reassessment tailored to therapy area: Another learning from SARS is that, not all departments would see a steady uniform recovery. Hence it would be key to rebalance purchase orders for drugs, equipment based on the patterns emerging of the different therapy areas seeing increase in occupancy. Instead of using the traditional demand models, deploy simpler assessment tools like drawing recent insights from analogue markets which are weeks / months ahead in reopening. Frequent collaborations on sharing knowledge with peers and national health authorities might yield lasting benefits.

Inventory pooling: Chain hospitals and multi-speciality hospitals could try to pool inventories to use the buffer stock available. This is drawn from the concept of warehouse pooling which retailers have successfully deployed in consumer goods and electronics. Sports medicine, wound care, essential drugs, consumables are possible areas where an inventory pooling might work

Capex shifts: Depending on the purpose, certain Capex decisions could be shifted to next year. For example hospitals with a 256 slice CT scanner can potentially delay in executing plans to upgrade to a 1152 slice CT scanner or revisit the payment models where a decision for an outright purchase is changed to a lease or a deferred payment schedule. Similarly, for new hospital wings coming up, the activation of new departments should be delayed as per the demand pattern being observed

Cash pooling: Cash pools reduce interest costs and increase efficiency of resources. While the concept is not new, traditionally only large-scale hospitals have opted for this solution. With increasing focus on serving SMEs in the banking sector, small to mid-tier hospitals too have options to partner with banks on integrated cash management offerings which include interest overlays and virtual accounts

Cost brakes: The biggest challenge in executing cost reduction at hospitals is usually around internal change readiness especially for clinicians. COVID-19 provides an opportunity to leverage the wave of embrace of new ideas and new ways of working: telemedicine, use of AI based triage, bots for disinfection are some examples. Cost containment quick wins could include use of locums based on adoption of telemedicine, consolidation for generics and consumable brands for purchases

With regards to Capex shifts and cost brakes, for ongoing fixed costs example use of reagents, assays, and other consumables, non-medical services, payment terms could be renegotiated leveraging scale, existing relationships, potential short term extension of contract for well performing vendors; the cash strain could be challenging for vendors, hence a quarterly review to monitor the situation, taping into mutually helpful options like supply chain financing could be considered.

Revised collections approach Universal healthcare groups' payment cycles might not be influenced with increased collection focus. However, for cash, employer sponsored programmes, collections from tax authorities such as VAT, and private insurance, a renewed collections approach which includes account segmentation (per cash requirements and strategic focus), reducing process bottlenecks, deploying a dedicated approach for reconciliation of outstanding payments and offering early payment discounts.

Innovative payment models: Hospitals have sporadically tapped into innovative payment solutions but with the adoption and embedment of telemed, they can start looking at developing new packages and solutions for cash and private insured patients, these could include pre-paid packages such as chronic conditions, subscription-based services (on-demand home-based care).

Uncertainty looms over the relative control we can gain over the pandemic. Hospitals face a conundrum of treating all patients, ensuring their safety, but also sustaining the business. Proactive cash management should provide some relief in the interim before strategic options like changing case mix, influenced resumption of elective procedures, and effective use of telemedicine and virtual care start becoming mainstream. Hospitals that rely less on financial stimulus and more on in-house cash release approaches will likely emerge stronger in financial maturity once the new normal arrives.