The central, provincial and local governments in China and the private enterprises (especially entrepreneurs) have been investing heavily in making healthcare efficient and affordable all over the country including remote regions for its 1.5 billion people. Thanks to the rapid development of the Internet and mobile technologies, China is seeing the development of many online platforms, such as wechat, ZTE, PingAn, Dingbei Doctor and Xiomi for supporting mHealth (healthcare using mobile technologies). This article investigates the growth of mHealth market in China based on the project called mHealth for Belt and Road region (mHBR) led by UM-SJTU Joint Institute and partners in 12 countries.

mHealth products provide online healthcare and medical services using mobile devices (e.g., smartphones) such as online consultation, online diagnosis, online health monitoring, online healthcare and fitness management, online doctor appointments and follow-ups, medical/healthcare related information database access, intelligent data processing, health record database, customer service call centres, emergency response assistance, as well as online purchase and delivery of medicinal and supplementary health products.

Thanks to the rapid development of the Internet and mobile technologies, China has been leading the world in several aspects of such technologies (e.g., 5G) and its applications to various sectors of social development including healthcare. The need to avoid patientdoctor contact (to reduce infections) during COVID-19 has given a strong push for telehealth services (especially mHealth) all over the world. Many countries now have reported a rapid uptake to mHealth services that are likely to be a part of the future healthcare scenario. Hence there is a need to forecast the deployment and growth of mHealth services, now part of Digital Health. This article is based on the experience of the University of Michigan-Shanghai Jiao Tong University Joint Institute (UM-SJTU JI) initiative called mHealth for Belt and Road region (mHBR) involving partners in more than 12 countries. The project led to an edited book, that defines mHealth as Mobile technologies (phones, drones, robots, Apps, wearable monitoring devices etc.) to transform the face of health service delivery across the globe, particularly in developing, remote regions. The mHBR project led to several collaborative subprojects as described in. It also led to several mHealth technology projects involving China and partner countries in the CFE at UM-SJTU JI.

This article investigates the market of mHealth in China based on a subproject of mHBR in the CFE at UM-SJTU JI. The article starts in Section 2 with a summary of some of the popular mHealth products and their features in China. Section 3 presents an overview of the Chinese mHealth market followed by Section 4 on the market growth, and Section 5 concludes.

Although there are many types on mHealth services with different facilities based on clinical or public health services, a typical mHealth service consists of the following elements:

Hospital partnerships enable users to interact with certified medical professionals. Pharmacy partnerships allow for purchasing of medicinal products and delivery via online access and transaction. Manufacturer partnerships allow for sensory device implementation and other medical equipment purchase that enables the enhanced functionalities of telehealth monitoring from the mHealth device.

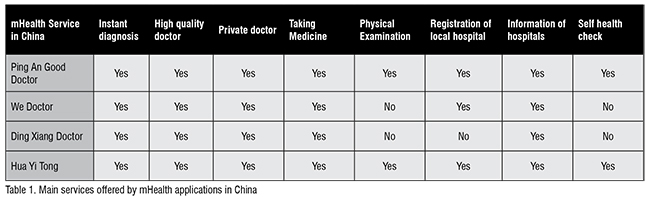

UM-SJTU JI CFE project teams have been investigating the development and use of mHealth in China as described in. That project carried out a comparison of existing mHealth products in China. With the advent of 5G technology in China, many mHealth applications and technologies have been developed over the last 5 years thanks to strong support from the government. However, since the market is vast and growing, there is still room in the market for new businesses to enter. Some prominent mHealth services in China are compared in Table 1.

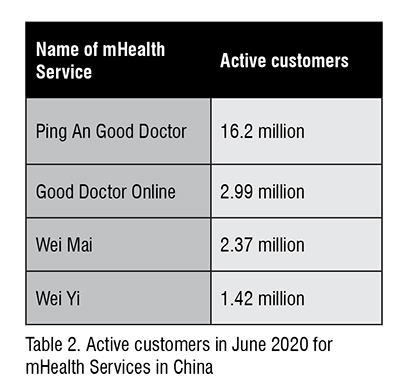

For example, the Ping An Good Doctor application offers various services such as online consultation, pre- setup appointments, online followups, online drugs purchase and other online medical services. With this being the largest, several other mHealth applications such as Hua Yi Tong, Wei Yi, Chun Yu Yi Sheng are also doing well. Table 2 provides the number of active users of some of these major mHealth services.

China has seen a massive growth in the reach and quality of healthcare services all over the country. Health professionals in China welcome technology (e.g., mHealth) to improve health services using latest technological developments, such as Artificial Intelligence (AI), Augmented Reality (AR), 5G etc.

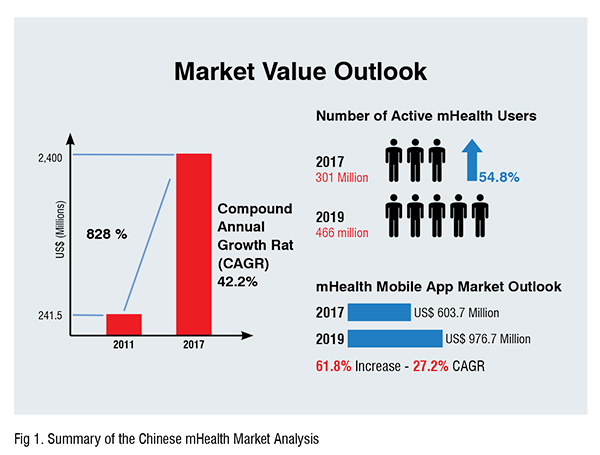

China is the second leading country in terms of mHealth revenue with a revenue of US$2.5 billion in 2017, which is only second to the United States (US$5.9 billion). China’s overall mHealth market value in 2011 was estimated to be around US$241.5 million while the market value in 2017 has risen to an estimated value of US$2 billion. This increase has been steadily growing over the years and is reflected in the increase of active users from 2017 to 2019. According to the country’s national statistical database, the number of active mHealth app/service users in the first quarter of 2017 is 301 million users. That number has increased to 466 million active users by the first quarter of 2019. The mHealth mobile application market value in China has also increased from a value of US$603.7 million in 2017 to US$976.7 million in 2019. The most used/accessed mHealth services that accounts for the given market value are online healthcare (online medical consultation, monitoring, diagnosis), which accounts for 44.5 per cent of cumulative user share, and online/mobile health management (fitness apps), which accounts for 38.9 per cent of cumulative user share. This is reflected in the overall market sharein the Asia Pacific countries by service category that consists of online health monitoring (55 per cent), online diagnosis (28 per cent) and online health practitioner support (7 per cent) as reported.

Analysing the data, the mHealth market value in China has experienced a growth of over 828 per cent from 2011 to 2017 with a CAGR (compound annual growth rate) value of 42.2 per cent. The number of active mHealth application/service users has also increased by 54.8 per cent in the span of 2 years (2017-2019) while the mHealth mobile application market has experienced a 61.8 per cent increase value during the same time span with a CAGR value of 27.2 per cent.

Based on this, it is apparent that the mHealth industry has been rapidly growing over the past years and does not show any sign of slowing down. In fact, the ageing problem in China has helped mHealth emerge as a feasible solution to monitor the chronic diseases of the elderly population through online healthcare applications/ services. The COVID-19 pandemic has also increased the Chinese population’s awareness towards personal health and the importance of telehealth for the safety of health professionals by means of mobile health monitoring. Consequently, the mHealth industry has recently experienced rapid advancements in its technology and research as well as acceptance by the public. This increased awareness by the Chinese population has translated into a 65 per cent increase in the global number of downloaded medical applications in 2020. Figure.1 summarises the current market of mHealth in China.

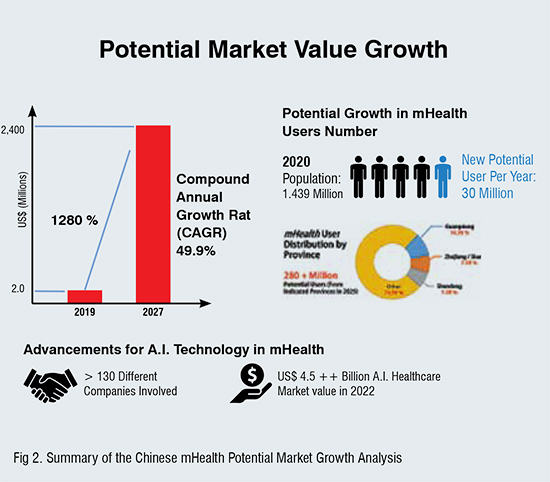

Based on the past market analysis of the mHealth industry over the decade, the future for the mHealth industry seems to hold many opportunities for growth. With the steady increase in market value and revenue the industry is currently experiencing, the potential profitability of the mHealth industry in China can be seen by analysing data regarding projected market values, potential number of users and advancements in the technology.

The global mHealth market value is expected to reach US$189 billion by 2025. The global healthcare industry is one of the largest industries in the world with an estimated spending of US$8.2 trillion per annum. According to market estimates, the worldwide online healthcare industry will keep growing in the future.

In China, the mHealth market size is forecasted to rapidly reach US$25.6 billion by the end of 2027 due to the COVID-19. In fact, the demand in using mHealth applications has risen significantly during the course of 2020, as seen by China’s largest mHealth application, Ping An Good Doctor, that experienced a 900 per cent increase in new users in the beginning of 2020. China is currently the most populous country in the world with a population of 1.439 billion people in 2020 and an average yearly increase of 0.39 per cent in population and the country can expect a huge opportunity in potential users, where the largest user share can be seen in provinces like Guangdong (10.3 per cent), Zhejiang and Shanghai (7.5 per cent), and Shandong (7.3 per cent) [3]. Finally, since China is one of the first few countries to have implemented 5G technology and has been focusing on AI developments in the healthcare industry, the mHealth industry and relevant online healthcare industries may see new, hitherto unseen applications of mHealth for the effective healthcare of its citizens. China is currently ranked as the No.1 country in the world for investments in AI technology in the healthcare industry. AI technology is now being intensively researched and implemented in various mHealth applications/services that focuses on medical imaging, assisted diagnosis, drug development, health management and disease prediction. With over 130 different companies involved in developing these AI healthcare technologies by 2020, the AI healthcare market in China is valued at far more than US$4.5 billion (2022, value given is only for AI gene sequencing market size) in the future. This advancements in AI technology in China indicates that the demand for personal health care monitoring, which is also enabled by wearable health technologies that has a total market revenue of US$6 billion in 2020, has been increasing rapidly and continues to increase. Figure 2 summarises the market growth outlook of mHealth in China.

Conclusions

This article has briefly analysed the mHealth market in China. It is apparent that the mHealth market size has the potential to increase by almost 1300 per cent from 2019 with a CAGR value of 49.9 per cent in 2027. The large population of the country will also account for around potentially 36 million new users each year given the country’s internet penetration with the most mHealth app/service user dense provinces offering a potential of 280 million users in 2025, which excludes the large number of expats that may come to China in the coming years. In addition, the aging problem in China also demands for these mHealth technologies to be developed faster as previously mentioned that mHealth provides a feasible solution to monitoring, diagnosing and even preventing chronic diseases, especially with the implementation of AI/data driven analysis in the online healthcare industry. Given the large medical database and proficient technological resources in healthcare provided by various sources in the country (Shanghai Jiaotong University Med-X Research Institute, Tencent, Alibaba, Ping An Technologies), in the future, various AI capabilities such as AI gene sequencing and AI medical imaging will certainly improve to deliver faster remote diagnoses and more accurate drug prescriptions and disease preventions through mHealth platforms. Thus, it is almost certain that the mHealth industry will prosper in the years to come in China and that may lead to healthcare benefits in the other developing countries near China.

REFERENCES

[1] Pradeep Kumar Ray, Naoki Nakashima, Ashir Ahmed, Soong-Chul Ro, Yasuhiro Soshino (Eds), Mobile Technologies for Delivering Healthcare in Remote, Rural or Developing Regions, IET Book Series on Health Technologies, 2020,ISBN 978-1-83953-047-0 (hardback) ISBN 978-1-83953-048-7 (PDF), https://shop.theiet.org/mobile-technologies-for-delivering-healthcare-in-remote-rural-or-developing-regions publisheed by IET Press, UK

[2] Soong-Chul Ro, Willy Jin Huang and Pradeep Ray, Advancing the Role of Entrepreneurship: Healthcare in Developing Countries, Asian Hospital and Healthcare Management (2019) Issue 44 (Feb 2019), https://www.asianhhm.com/healthcare-management/advancing-role-of-entrepreneurship, last accessed October 9, 2019

[3] Steven Wijaya and Zhang Junxiang, Business Plan about Shennong Remote mHealth Service, Submitted to JI CFE as a Report on Technology Entrepreneurship, November 2020

[4] Capgemini. Digitial Health: Transforming Healthcare. 2018. https://www.capgemini.com/be-en/wp-content/uploads/sites/17/2018/10/Digital-health-final-paper-22.10.pdf.

[5] ReportLinker. Global Mobile Health Industry Report. July, 2020. ID: 5896214.

[6] Innovation Centre Denmark. China AI Healthcare. Ministry of Foreign Affairs of Denmark. 2019