Healthcare IT Funding and M&A 2016 Fourth Quarter and Annual Report

Funding and merger & acquisition activity for the Healthcare IT / Digital Health sector

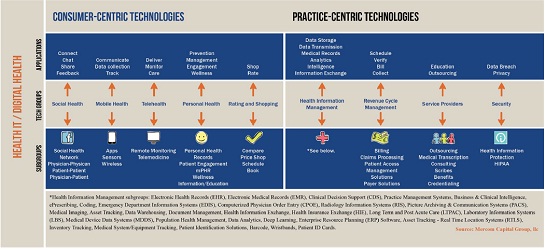

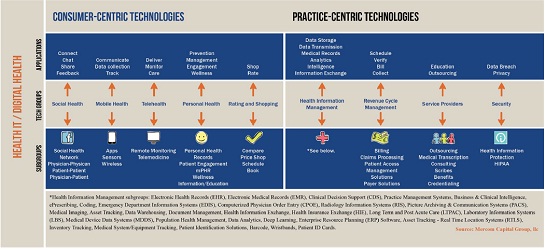

The report covers the technologies listed below and the sub-technologies under them.

Technologies Covered in This Report

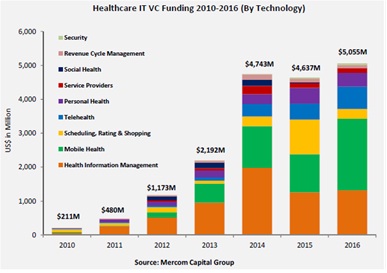

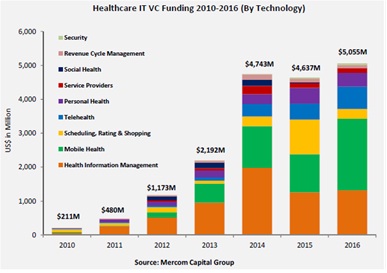

- Global Healthcare IT/Digital Health venture capital funding grew nine percent YoY with more than $5 billion in 622 deals in 2016, compared to $4.6 billion in 574 deals in 2015.

- Total corporate funding into Healthcare IT - including VC funding, debt and public market funding - came to $5.6 billion in 2016 compared to $8 billion in 2015.

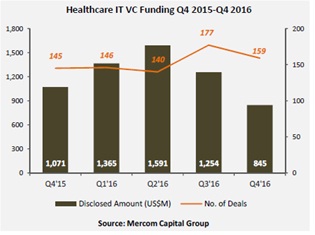

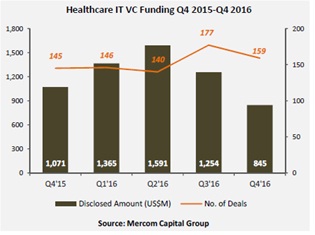

- VC funding for Healthcare IT companies in Q4 was $845 million in 159 deals compared to the $1.25 billion in 177 deals in Q3 2016.

- Healthcare practice-focused companies raised $1.6 billion in 185 deals, accounting for about 32 percent of the total funding.

- Consumer-focused companies received about $3.5 billion in 437 deals, accounting for 68 percent of the total funding raised.

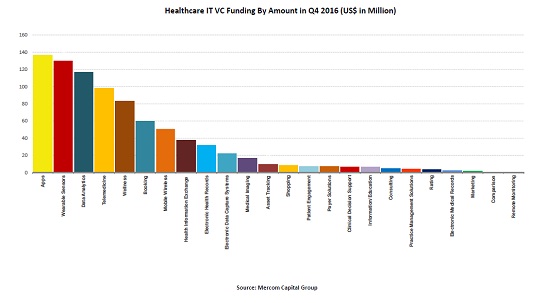

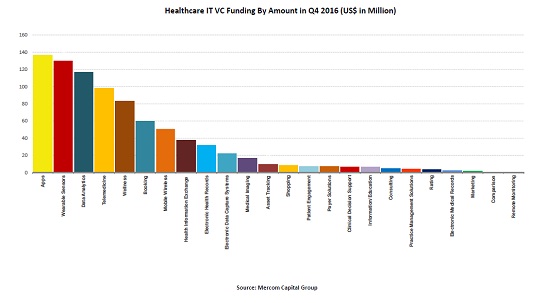

- The top funded Healthcare IT areas in 2016 included Mobile Apps, which received almost $1.3 billion, Wearable Sensors with $592 million, Data Analytics with $574 million, Telemedicine companies with $528 million, Mobile Wireless companies with $228 million, and Wellness with $218 million.

- The top VC rounds in 2016 were the $500 million round by Ping An Good Doctor, Chunyu Yisheng’s $183 million, Flatiron Health’s $175 million, Jawbone’s $165 million, and Meet You with $151 million.

- The average deal size in 2016 was $8.1 million, similar to 2015.

- There were 35 countries that recorded Healthcare IT VC funding activity in 2016. Most of the funding was logged in the United States with over $3.4 billion in 431 deals. Countries other than the United States accounted for 33 percent of the total funding with more than $1.6 billion.

- Within the United States, California companies continued to receive the most funding with $1.3 billion in 143 deals. New York was second with $440 million in 49 deals.

- For the first time, Health IT investors crossed 1,000. A total of 1,115 investors (including accelerator/incubators) participated in VC funding rounds for Healthcare IT companies in 2016 compared to 923 in 2015.

- There were 22 accelerators and incubators who participated in 83 deals in 2016, compared to 2015 which had 55 deals involving 14 accelerators and incubators.

- Announced debt and public market financing for Healthcare IT companies fell to $533 million in 18 deals in 2016, compared to $3.4 billion in 29 deals in 2015.

- There were four IPOs in 2016 raising a combined $234 million compared to seven IPOs in 2015 raising a total of $2.2 billion.

- There were 205 Healthcare IT M&A transactions in 2016, slightly lower than the 219 transactions in 2015. There were 43 disclosed transactions in 2016 compared to 46 in 2015.

- Practice-focused companies were involved in majority of M&A deals in 2016 with 131.

- Consumer-focused companies were involved in 74 M&A deals in 2016.

- HIM companies were involved in 89 M&A transactions followed by Mobile Health companies with 26, Data Analytics companies with 19, Telehealth and Personal Health companies with 18 each, and Scheduling, Rating & Comparison Shopping companies with 12.

About Mercom’s Healthcare IT Funding and M&A Report

Mercom was one of the first research firms to track funding and M&A activity in the Healthcare IT sector, starting in 2010.

Here is how our report is different: Our report includes deals of all sizes, globally, to present a complete picture of Healthcare IT funding and technology trends. As an independent research firm, we have no conflicts of interest with companies covered in this report.

- This is the most comprehensive report covering funding and M&A deals of all sizes, globally. The trends revealed in this report give a more complete picture of the industry.

- This report does not cover bioinformatics and medical devices.

- All charts, graphs, and trends are clearly categorized and defined by technology and sub-technology groups.

- This report includes concise deal information for every transaction.

- This report covers historical trends.

- As the industry evolves, our report evolves with it and we continuously improve the information, analysis, charts, and trends covered every quarter.

Our subscribers include companies and executives from venture capital, private equity, investment banking, healthcare, healthcare IT (aka digital health and eHealth), insurance, healthcare associations, universities, tech firms, and more.

| Audience |

Why they like our reports |

| Venture Capital/Private Equity |

leads from early-stage deals, technology trends |

| Investment bankers |

leads for funding and M&A deals, investor leads |

| Healthcare IT, Digital health |

sector trends, investor targets (by funding behavior, including technology, technology partnership targets, and more) |

| Insurance companies |

acquisition leads, investment leads, technology partnerships |

| Large healthcare & Tech firms |

acquisition leads, R&D partnerships, investment leads |

DISCLAIMER: © 2017 by Mercom Capital Group, llc. All rights reserved. Mercom hereby grants user a personal, non-exclusive, non-refundable, non-transferable license to use the Report for research purposes only. Mercom retains exclusive and sole ownership of all its Reports. When quoting from this report, please cite “Mercom Capital Group, llc”. Information contained in this publication is derived from carefully selected sources we believe to be reliable. Mercom, its employees, affiliates, agents, and licensors do not warrant the accuracy, completeness, currentness, non-infringement, merchantability, or fitness for a particular purpose of this report. Nothing in this report constitutes or should be taken as investment advice. For information about this document, please contact us at 512-215-4452 or via email at: HIT@mercomcapital.com.