Asian healthcare systems have developed some of the highest quality, value-based services in the world. However, access to one critical, fast-growing service line in particular is mostly untapped across Asia: Advanced wound care. The authors explain some of the key opportunities, challenges, and other considerations to assess when planning and executing these greatly needed wound care programs in the region.

Introduction:

Asia has developed some of the highest quality, patient-centric, cost-effective, and value-based medical services in the world. From specialty1 ophthalmology, cardiovascular, and orthopedic care, to organ transplants, plastic surgery, and dental procedures–excellent healthcare, the same or better than in the West, is available to locals and medical tourists alike. But access to one critical, fast-growing service line in particular is mostly untapped across Asia: Advanced wound care and management.

Based on patient demographic and other trends, as well as the authors’ firsthand involvement in the global wound care markets, the potential across Asia is incredible. With around 8 million advanced wounds per annum in the US alone, the burden of advanced wounds in Asia numbers in the tens of millions, and is expected to grow exponentially in the years ahead.

In this article, the authors will leverage their experience in developing, managing, and advising advanced wound care services2 to provide an overview of this need and opportunity for healthcare executives, investors, and clinicians across Asia.

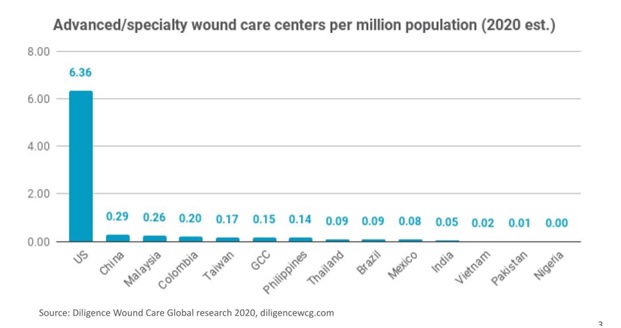

Figure: On a per capita basis, emerging markets across Asia and elsewhere are lacking in specialty wound care services infrastructure.

Source: Diligence Wound Care Global research, 2020. https://diligencewcg.com3

What are advanced wounds and how are they treated?

A definition of “advanced wound” is a wound that does not–or is likely to not–heal within 30 days absent of advanced treatments. This includes a subset called, “chronic wounds” such as diabetic foot ulcers (DFUs), pressure ulcers (bed sores), venous leg (venous insufficiency / stasis) ulcers, malignancies (tumors), and others whose root cause involves patients’ underlying health conditions. Additionally, difficult-to-heal wounds such as large/deep burns, trauma, and surgical incisions often meet this definition. Even normal aging processes deteriorate the human body’s ability to fight infections and heal itself over time. Indeed, many such wounds are impacted by multiple factors.

Best practices for advanced wound treatment involves an interdisciplinary approach. This often includes everything from optimising nutrition, diabetes management, and pain management, to vascular and plastic surgery. For example, specialty consultations, procedures, and products to simultaneously improve blood flow to the area, optimise kidney function, remove non-viable tissue, balance moisture, and manage infection, are illustrative of some typical interventions used to manage advanced wounds.

Ideally, the wound(s) can be healed. But in many cases, ongoing management is appropriate. This is especially the case when the patient’s underlying conditions cannot be resolved.

Why develop advanced wound care service lines?

Depending on the market, model, and other considerations (public vs. private, complementary service lines, regulatory and reimbursement systems, etc.), there are many reasons for stakeholders–from hospital executives, to investors, to entrepreneurial clinicians–to develop advanced wound care service lines. They include:

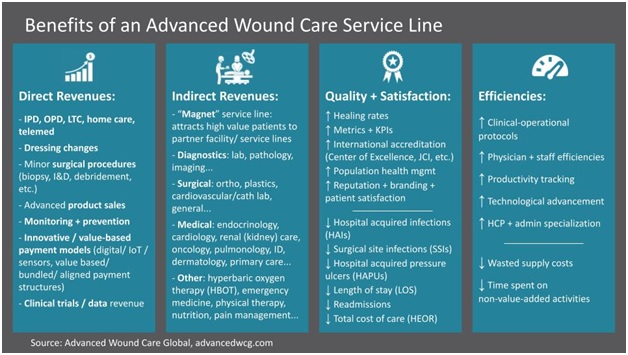

The figure below details the key benefits of developing an advanced wound care service line:

Figure: Advanced Wound Care Centers of Excellence and related healthcare programs offer a variety of direct and indirect benefits, including clinical quality, operational efficiencies, and positive financial impact.

Source: Advanced Wound Care Global, 2022. https://advancedwcg.com4

What are some examples of successful advanced wound care delivery models, and how are they approached?

In terms of advanced wound care products, major multinational firms such as Smith & Nephew, 3M, Convatec, Coloplast, and others, as well as hundreds of small firms and startups across Asia, offer a variety of medical devices and other treatment options. Globally, this market is about USD $10 billion per year.

However, in terms of specialty wound care services, there do not yet exist large-scale services providers in Asia the same way that companies like B. Braun and DaVita, for example, offer renal / dialysis care across markets such as China, Malaysia, Singapore, Thailand, The Philippines, Vietnam. In recent years, some of the major players have made initial moves to enter the Asian wound care services market. But these are still in the early stages.

Statistically, advanced wounds tend to disproportionately impact lower and middle income patients. However, since there is such a lack of availability of specialty service lines in Asia and elsewhere, there are multiple examples of successful cash-pay wound care service lines. Some of them even rely on medical tourism for most of their revenues. Especially in markets with high willingness to pay out-of-pocket for medical treatments such as in India, Malaysia, and Thailand, this is a trend that will continue.

Another successful model, for example some wound care programs in China and The Philippines, will focus on billing government and/or private insurance for high-volume, low-reimbursement consultations and procedures to help pay for overhead and operating expenses. However, a large amount of the actual profits will come from out-of-pocket cash payments paid by patients who wish to utilise advanced products.

Yet a third driver of new advanced wound care models is related to new regulatory developments. In late 2019, China announced5 that many secondary and all tertiary hospitals must develop specialty programs for the diagnosis and management of chronic wounds. These include specific requirements for staffing ratios, training, assessments/diagnoses, and use of advanced technologies. Although implementation deadlines were delayed due to COVID, this new directive has already begun to accelerate the opportunities for wound care management and related products and services across China. In recent years, this has helped drive an increase in China’s wound care units and departments by several hundred percent.

A fourth wound care model that is gaining traction in Asia–and again in China in particular, is the uptake in telemedicine and related virtual care. Much of advanced wound care is a “hands on” specialty (cleaning wounds, changing bandages, etc.). However, virtual care can aid with some aspects of assessment, monitoring, and triage to potentially reduce the frequency of some in-person visits. Across Asia, family and/or caregiver involvement tend to be more common than in North America and Europe. Likewise, there have been efforts by some forward-thinking product firms to sponsor and/or subsidise the delivery of virtual services via e-commerce ordering of their physical wound and skin care products. Wound care can also benefit heavily from sensors in dressings and remote patient monitoring (RPM), such as to detect when a bandage should be changed, or when a wound might be infected. These types of developments, together with the embracing of mobile and digital health technologies during COVID, have opened the door for viable physical-virtual hybrid models of advanced wound care, which are evolving rapidly.

How should executives, administrators, and clinicians go about planning, developing, and implementing an advanced wound care service line?

When one knows what they are doing, the cost to launch advanced wound care services is typically much less expensive than other healthcare services initiatives such as surgery centers, imaging centers, cancer centers, etc. However, since it is a new and fast-evolving area, it can be dangerous to invest in and operate without experience in both global best practices, as well as wound care in the local market(s).

If implemented incorrectly, a “best case” problematic scenario might be a low-value service line of simple wound dressing changes that generates little to no revenue. On the other hand, a “worst case” scenario can lead to poor clinical outcomes (including avoidable amputation, sepsis, and death), which can lead to medical-legal malpractice claims, negative impacts to your (brand’s) reputation, and other negative consequences. So despite the huge upside, a poorly planned and executed wound care program can be offset by the potential downside.

While each market and situation is unique, it is beneficial to co-develop the program with a partner that is highly experienced in international advanced wound care delivery (such as the authors). Rather than simply copy elements from the US, Europe, or other markets, it is critical to adapt them to the local ecosystem–without sacrificing medical, operational, or technological quality considerations.

Some key questions to consider in nearly every situation include:

Advanced wound care management: The next frontier in Asian healthcare?

Exploding health trends across Asia such as aging populations, diabetes, obesity, cardiovascular disease, renal (kidney) disease, cancer, autoimmune disease, and dozens of others, are all driving increased chronic and other advanced wounds.

While Asian healthcare systems, investors, and entrepreneurs are making major strides to develop healthcare services infrastructure to address each of these conditions individually, there exists relatively little capacity to address the advanced wounds and amputations that develop as a result of those conditions. Stated differently, the availability of high quality, specialised wound care service models in the region is nowhere near enough to meet the current and projected need across the region.

The authors have shared some background and initial considerations from their deep experience in the advanced wound care sector across Asian and other global healthcare markets. Asian healthcare executives and administrators considering going after this attractive opportunity should consider both the scope and scale of the services needed, as well as strategies for how to address the opportunity in a sustainable and scalable way.

References:

1) Delivering World-Class Health Care, Affordably

https://hbr.org/2013/11/delivering-world-class-health-care-affordably

2) Advanced Wound Care Global, 2022. https://advancedwcg.com

3) Diligence Wound Care Global research, 2020. https://diligencewcg.com

4) Advanced Wound Care Global, 2022. https://advancedwcg.com

5) (国家卫生健康委办公厅关于加强体表慢性难愈合创面(溃疡)诊疗管理工作的通知 Notice of the General Office of the National Health Commission on Strengthening the Diagnosis and Management of Chronic Refractory Wounds (Ulcers) on the Body Surface, China Medical Administration and Hospital Authority, 2019

http://www.nhc.gov.cn/yzygj/s7659/201912/602716f0471944b8b63b0adabe4546df.shtml