Point-of-care diagnostics are a potentially profitable growth area for the healthcare industry. However, there are several issues to be overcome before any point-of-care instrumentation can be successfully commercialised.

Point-of-care diagnostics—either for home use or for a “near-patient” environment such as the general practitioner's surgery—are a potentially profitable growth area for the healthcare industry. However, there are several issues to be overcome before any point-of-care instrumentation can be successfully commercialised. These include the demonstration of clinical benefit, arrangements for reimbursement, delivery at acceptable cost, meeting regulatory requirements, assurance of acceptable quality, and dealing with stakeholder perceptions. We discuss each of these areas in turn and suggest ways of addressing them.

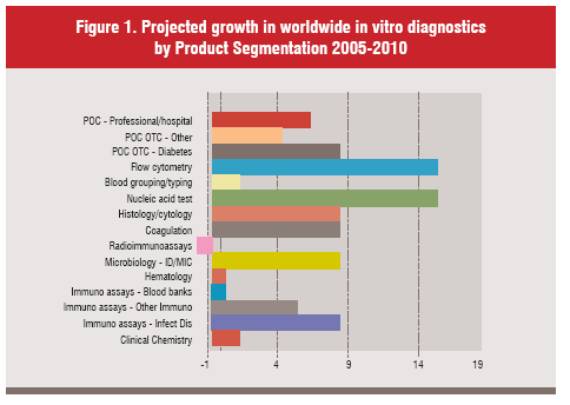

For both large and small diagnostic companies, today’s diagnostics market is challenging. Large players typically have many products that are mature and moving into a phase where profit margins are being squeezed as competition becomes more intense. A 2006 study by Kalorama Information projected a compound annual growth rate in clinical chemistry of only 2% until 2010. Figure 1 shows predicted growth over the period 2005-2010. 1 The slow growth rates in some sectors has resulted in a period of divestment by the larger companies to smaller companies who are happy with the steady revenue these areas can provide—this can be reflected in the disposal by Roche in some of their Opti blood gas analysis businesses to Osmetech in 2005.

An alternative way to extract additional value from mature testing technologies is to move them closer to the patient. In this way the tests can be potentially sold in greater volumes. This offers both the clinicians, and increasingly healthcare accountants, the opportunity to identify a disease earlier and potentially reduce the number of days an individual patient may be incapacitated and therefore, avoid using expensive hospital facilities. However, this area has been highlighted as a potential growth area for many years, but recent market surveys predict growth to be only 7% over the next 5 years 1, whereas areas such as molecular diagnostics are predicted to grow at around 16%.

The US market consists of approximately 900,000 physicians and approximately 25,000 offices have some level of Clinical Laboratory Improvement Amendments of 1988 (CLIA) waiver and the number continues to grow. However, that still leaves at least a further 200,000 potential POC sites including physician offices and clinics. To enable uptake of POC testing by these facilities, we suggest that several key strategic issues must be addressed:

To make a POC proposition viable, it is necessary to develop a business case that will convince both regulators and reimbursement bodies of the value of the new test. As with any diagnostic test, proven clinical benefit will provide the strongest motivation for adoption. Diagnosis in general has an obvious clinical benefit since over 70% of healthcare decisions are made following a diagnostic result, 2 in this context, however, it is necessary to show an advantage to POC diagnosis.

That advantage differs somewhat depending on whether the condition being tested for is acute or chronic. In the case of an acute condition, POC diagnosis can improve the patient outcome by allowing a reduced time to result, and hence faster initiation of treatment. Group B Streptococcus (GBS) provides an example. One in 20 babies infected with this common condition dies, while many others suffer long-term health problems. 3 The availability of a 15minute test in the delivery room would allow physicians to prescribe intravenous antibiotics prior to delivery. Clinicians tell us that POC testing in this case would confer considerable benefits. However, the use of tests for STDs and H. pylori would, on the surface, appear perfect candidates for POC testing. This has not been the case and reasons are not totally clear, but the expectations of a 30 minute wait could be one issue, along with the fact that many of these tests at this time are not as sensitive as the laboratory based methods.

In the case of a chronic condition, the POC advantages again include a reduced time to result in comparison with a lab test. In addition, there is likely to be a decreased use of hospital resources and a lower risk of sampling errors. Patient compliance and satisfaction is likely to be enhanced, especially with a home test. Roche reports a recent clinical trial which has shown that patient self-monitoring with a new coagulation test, Coagucheck S, “can reduce the risk of severe complications and minor haemorrhages by up to 70% in patients on oral anticoagulant therapy… and that it can reduce mortality after heart valve replacement by 60%.” 4

It is also necessary for the business case to show how any potential disadvantages of POC diagnosis can be offset. One possible objection concerns the management of data collected remotely; for successful follow-up, records need to be kept of the test readings. Data collection is harder, but not impossible, in the home setting. The device might need to have a wireless communications adapter, or to be plugged into a telephone line. Now that communication is relatively inexpensive and governments (in the UK at least) are favourably disposed to central integration of patient data, this proposition is quite realistic.

Without reimbursement, there is no incentive to use any diagnostic tool, and hence no market. This is a problem area because in many countries there is chronic under-reimbursement for diagnostic tests, with prices pegged so that, for example, Medicare is effectively paying less each year for better tests.

In addition, the structure of reimbursement is often inimical to diagnostic tests. In the US and Germany, authorities reimburse hospitals for the entire cost of treating a disease, so that if the patient stays in hospital longer than anticipated the hospital has to bear the cost. That structure can discourage the use of diagnostic tools if they see extra testing resulting in reduced profit, or worse still potential financial loss per patient.

There is little doubt that reimbursement practices and structures constitute a barrier to development of better tests—a fact that arguably affects clinical practice for the worse, since it faces both a reluctance to use diagnostics with a lack of better tests in the future. In short, the global reimbursement situation vis-à-vis diagnosis is in urgent need of review, something it has not received since the 1980s.

There are already encouraging signs in the US. The Lewin Group delivered a report on diagnostics for the Advanced Medical Technology Association in July 2005. 5 It found that diagnostics were underused half the time in connection with diseases like cancer, heart problems and diabetes, and that more testing would avoid many adverse events and could save almost $900 million in avoidable healthcare costs.

In the meantime, for organisations that are considering developing a POC test, it is important to communicate with reimbursement authorities early on in the development process; there is no point in continuing development unless reimbursement is assured. Developers should present reimbursement bodies with a compelling business case showing why the test will add value. This can be enhanced by, wherever possible, embedding reimbursement experts into the development team from the outset of any new programme. From our experience it is not unusual for these individuals to have little input into a diagnostic development until late in the process.

Perhaps, novel means of reimbursement may also enhance the opportunity to extract maximum value from any new diagnostic. Different interest groups may enhance the value of a test and therefore act as a convincing lobby in generating reimbursement at an appropriate level. For example, home tests may be influenced by advertising and marketing a product directly to a patient, thereby, generating a new interest body in establishing reimbursement.

POC testing brings savings that may justify a somewhat higher per-test cost than is acceptable for a centralised test. Laboratory and hospital testing usually involves expensive equipment (though the consumables are cheap). A POC test usually eliminates that high cost of equipment. In addition, some of the overheads of monitoring by a specialist physician or technician are saved by a POC test, especially a home test. Any organisation that brings testing nearer to the patient may be able to argue for a higher price because of these savings, in particular where a rapid intervention offers a significant clinical benefit. However, for this to ring true the Point-of-Care systems must carry an inherent low manufacturing cost to justify the placement of several systems (for the same purpose) in a single medical facility. In the case of a doctor’s surgery or emergency room, an excessive hardware cost is likely to prevent market penetration. In conclusion, any point of care system would have to be of low complexity with low hardware costs.

Most countries have special regulatory requirements for POC tests, since they must be capable of accurate administration and interpretation without the aid of technicians. If a test is sufficiently reliable and easy to use, it can in the US be exempted from ongoing regulatory oversight under the CLIA law. In most cases the FDA requires both home and near-patient tests to have this “CLIA waiver”.

For tests of “moderate complexity” those not simple enough to qualify for the waiver there is in the near-patient environment the alternative of setting up quality systems to ensure that the system is correctly used. However, this alternative is likely to be unappealing for most doctors’ surgeries, so manufacturers of POC tests should aim for the CLIA waiver.

To obtain a CLIA waiver, manufacturers have to show that POC users generate data equivalent to those that would be produced in a lab. They also have to show that the system is failsafe, that is to say that a failure will not give any information that may be interpreted as a data point; it is better to convey no result than a wrong result.

In the POC environment, there are likely to be no technicians present to insist on proper control and calibration. Instead, it will be necessary (except perhaps in the case of CLIA-waivered equipment) to instigate centralised control systems that communicate electronically with the equipment and collect performance data. A diagnostic group should have responsibility for monitoring based on this data, and should also have the ability to manage the system, for example locking out individual operators, or even shutting down the entire system, if performance falls below an acceptable level. This, of course, leads to issues over systems potentially “being failed” in critical situations. However, it may be less harmful to a patient to wait for a result rather than have the wrong information reported from poorly performing operator or piece of equipment. This type of centralised monitoring requires connectivity between POC equipment and a centralised facility. Such connectivity is now cheap and easy to achieve.

For home tests in particular, remote monitoring could have the additional benefit of allowing the data to be interpreted, and the patient’s condition managed, by remote experts, whether clinicians or physicians. These experts could encourage patients to comply with their therapy and could adjust treatment in response to the patient’s condition.

The other difficulty with new tests is that they still have to be compared to “gold standards”. This means the laboratory will have to continue performing upto the gold standard, even if it is less efficacious. This has resulted in an environment where new tests do not replace the old, but merely add to the menu, and result in diagnostic groups continuing to order the old as well as the new. This is clearly reflected in the use of CK-MB as a cardiac marker gold standard. It is widely viewed that troponin is a superior marker but sales of CK-MB have not diminished at all.

The attitudes of various stakeholder groups will influence the acceptability of a POC test. For a home test to be accepted, patients must want to test themselves, while doctors must be willing to relinquish control.

Let us first consider the perceptions of clinicians. They want to offer the best clinical option, but are starting to talk in terms of “the best option at the best price” a change which opens up the possibility that they will be receptive to home tests. At present, clinicians tend to perceive POC tests as expensive, but this is usually because they operate in cost silos and do not yet appreciate the full costs associated with late diagnosis or poor monitoring. Doctors also want to keep control of data interpretation, an objective which near-patient testing supports, since it can present raw data for interpretation by the physician rather than having it processed first by a technician. However, doctors often believe that the best-quality testing is performed in labs, and so it is up to suppliers of POC tests to convince them otherwise. Finally, clinicians set a high priority on turnaround times. Again, this perception mitigates in favour of POC tests since they are usually designed to deliver a “while you wait” result—ideal particularly in the case of patients being tested for a condition such as HIV, who often do not come back for their test results.

What about the perceptions of technicians in centralised laboratories? They are concerned that decentralised tests may not be as accurate as lab tests, a consideration that can be addressed by either the CLIA-waiver route or with remote monitoring, both of which can ensure that all systems operate to the same level of safety, quality and reliability. Technicians too, may see POC tests as more expensive, but again this perception arises from a partial view of current costs.

The perceptions of patients are also extremely important. In general, the public likes POC testing, and they could constitute the strongest force in pushing for acceptance by the medical profession. The trip to a local hospital or clinic in order to have a routine test performed can be more stressful than the actual output of the test in today’s congested cities. Maybe it is time to let the patient take more control over their well being. However, many of the current tests are blood based, and although diabetics perform blood analysis daily, many find this approach unattractive. In many cases individuals are also unwilling to find out what is wrong with them. But, like statins, marketing direct to customer may change the perception of self-testing and open up the “over the counter” (OTC) market before the technology is widely adopted in clinical settings. This can be illustrated with OraSures move to generate a self test HIV kit and developments is this area may open opportunities that will allow for the much publicised growth rates of 20-25% heralded in the late 90s.

All things considered, if manufacturers can prove a clear benefit from a POC test and ensure issues of reimbursement and quality are satisfactorily resolved, then physicians, conservative as they are, likely to accept the test.

1. The worldwide market for in vitro diagnostic tests, 5th Edition. Kalorama Information 2006.

2. Forsman RW. Why is the laboratory an afterthought for managed care organisations? Clinical Chemistry 1996. 42: 813-816

3. Roche investor update 2005,

4. P. Dermer et al. A history of neonatal Group B Streptococcus with its related morbidity and mortality rates in the United States. Journal Pediatric Medicine. 2004. 19(5): 357-363

5. http://www.advamed.org/publicdocs/thevalueofdiagnostics.pdf accessed 9th May 2006