Emerging technologies will come together in unprecedented ways to create efficiency and sustainability in healthcare. Mobility solutions will be the key technology in Asia with a high adoption rate of smartphones and tablets. Cloud will provide the essential infrastructure required for data access at point-of-care. Analytics will provide real-time views and deep insights required to create that sustainability

Over the past couple of years, there seems to have been a distinct change in the kind of questions healthcare IT executives have been asking us at IDC Health Insights. Previously the questions were invariably about which clinical or administration solution provider is preferred by other provider organisations in the region. Recently, the questions have been around global and regional best practices on newer technology implementations in hospitals, whether public or private. Emerging technologies like mobility, cloud, analytics/ Big Data and social business are referred to as the 3rd Platform at IDC. Increasingly, healthcare IT executives are getting interested in leveraging these technologies in their organisations, in an attempt to align technology with business goals.

Asia is seeing several isolated examples of innovation, the emergence of a collaborative healthcare environment as well as a trend towards consumerisation of healthcare IT, where consumers are taking ownership of their own wellness and chronic disease management. This growth in consumer interest in their own health outcomes is forcing provider organisations to focus on patient satisfaction as a key business driver.

New technologies will come together in unprecedented ways to create efficiency and sustainability in healthcare. Mobility will be the key technology in the region, with a high adoption rate of smartphones and tablets. By IDC's estimates, Asia-Pacific smartphone shipments will reach close to 510 million units by 2017, up from 300 million units in 2012. Cloud technologies will provide the essential infrastructure required for access to on-demand healthcare data at point-of-care. Analytics and Big Data technologies will provide the real-time views as well as deep insights required to create a sustainable system, as it moves from a reactive to a prescriptive phase.

Mobility has emerged as a key technology as it helps enable a patient-centric approach to cope with rising healthcare costs and resource shortage. It is the answer to meeting the rising consumption of health services due to ageing populations, chronic diseases, rising patient expectations, and growing costs of treatment. In developing countries, mobility solutions will be the short-cut to achieving universal healthcare over the next few years. In Asian hospitals, clinical mobility, especially in the case of bedside administration, and remote access to clinical data, has become increasingly common.

In a recently conducted survey by IDC Health Insights where 407 Asia/Pacific healthcare IT executives were interviewed, implementation of an enterprise mobility strategy emerged as a key concern. When asked about the organisation's mobility adoption, 37 per cent of the respondents indicated that they have already implemented mobility in some form, 44 per cent of the respondents are in the evaluation / planning stage, while only 19 per cent of the respondents indicated that they had no immediate plans to adopt mobility. However, only about 9 per cent of the respondents indicated that they had a mobility solution, while many organisations are focused on the devices and mobile apps.

Over the past few years there has been a buzz around Bring Your Own Device (BYOD) policies in all industries, including healthcare. In Asia-Pacific healthcare, the main driver for BYOD has been the clinician's desire to use a single device for personal and clinical use. Faced with the possibility of unknown breaches, the IT executive works to have registered users, while giving them differential, role-based, access and network connectivity. BYOD is essentially a compromise between clinicians and the healthcare organisation. The organisation will reluctantly allow physicians and staff to use their own devices at work. Due to security concerns, IT is unlikely to fully trust a clinician's personal device and therefore will not fully utilise the capabilities of that device, limiting the clinician's use of the device to deliver better healthcare.

In many healthcare organisations, as in other industries, a new trend is emerging. Eligible users are given a choice of devices that they can use for work, also referred to as the "choose your own device" (CYOD) model. CYOD is a new spin on the traditional corporate-liable mobility model in which the enterprise takes full ownership of the device. Unlike traditional corporate liable model, where the organisation manages only one mobile platform with limited choice of mobile devices, CYOD will have IT manage a few mobile platforms and offers a wider range of popular mobile devices, clinicians actually want to use. Essentially, CYOD allows IT to take back control of mobility management while giving clinicians choices on the devices.

More than mobilising the individual, mobility strategies need to take into consideration the processes and workflows, which are particularly important in a process-driven industry like healthcare. While iOS and Android devices remain popular among end-users, many healthcare organisations looking for enterprise mobility solutions are keen to evaluate and pilot Windows-based platforms, to ensure continuity in supporting the administrative and clinical workflows that already run on Windows PCs. However, they are evaluating how Windows-based mobility solutions will work with the mixed applications that exist in health organisations.

IT has become more pervasive in healthcare organisations in Asia. However, given the traditional siloed structure of the procurement process, , many organisations have been adding applications without evaluating the existent overlapping functionalities and the feasibility of integration with other solutions towards a common procurement process.

One specific area where healthcare IT executive is questioning legacy approaches is clinical data and image management, and the cost and operational impact of maintaining enterprise data and storage. As patient data and medical images are increasingly being shared across departments and affiliated organisations, healthcare providers are looking for ways to provide a level of transparency in giving access to this data, and to centralise enterprise storage; and thus are beginning to explore options that allow this. Providers will increasingly begin to implement Vendor-Neutral Archives (VNAs). There will be a need for these archives to normalise the images, regardless of the PACS and make them easily accessible. There are a number of cloud-based archiving services focussed on medical image data, offered by healthcare IT suppliers and traditional IT infrastructure suppliers alike. The use of centralised solutions for storage of medical data and images will be the first move of healthcare organisations toward a cloud environment.

The healthcare IT executives also have as an important mandate the better utilisation of resources and simultaneously have the responsibility of implementing newer technologies within the same budget. 'Do more with less' is a popular mantra in Asian hospitals. Current infrastructures are being rationalised using virtualisation techniques and by aggressively adopting X-as-a-service delivery models. Decisions to implement or maintain each solution in-house are being driven by strong financial and ROI analysis. Given the fast pace at which the industry is changing in the region, infrastructural consolidation ensures better utilisation of resources, cost reduction, security management, and gives the organisations more flexibility and agility.

Consolidation and rationalisation has become a reality in Singapore, where six public health clusters have a shared service like arrangement, when it comes to IT infrastructure. Singapore's central G-Cloud, a private infrastructure for whole-of-government use, with complete security and compliance requirements, including onshore hosting, paves way for similar options in healthcare sector, as the surge in structured and unstructured data continues. Other countries in the region, like New Zealand, Taiwan, and Hong Kong, have initiated projects to roll out cloud models for whole-of-government use, with the vision of government agencies using resources on a pay-per-use basis. With these initiatives, widespread use of cloud technology, especially for office productivity, and back-end solutions will become a reality in the region.

In the recent survey conducted, it became clear that there is an interest around quite a few innovative X-as-a-service models for different functionalities, in Asia-Pacific healthcare. What is interesting in the survey results is the ambition to migrate clinical application systems onto a cloud environment. Fortis Hospitals in India recently announced a similar move which gained the attention of healthcare IT executives in the region.

Analytics to evaluate operational efficiency and financial operations have been in play at advanced healthcare organisations in the region for a while now. The key focus has always been on giving management and other stakeholders a dashboard view of operations and financials. However, with the growing industrialisation of healthcare, the consumer assumes a new significance, with organisations having to focus on clinical outcomes and patient satisfaction.

When asked the purpose of the intended and current use of analytics in healthcare organisations of the region, nearly 46 per cent of respondents indicated that they were interested in analysing clinical information. Clinical analytics with an eye on patient safety to improve clinical outcomes appears to be the key concern. Increasingly, organisations will establish clinical decision support, standard treatment protocols, and align clinical data to operational efficiency and patient satisfaction. Australian initiatives, such as 'MyHospitals' and 'My Aged Care', aim to make information about healthcare providers transparent. These Web sites provide information about the key parameters of the organisations' performances when benchmarked against the national standards. The Singapore government's initiative for medical bill transparency will find advanced use of clinical analytics.

The idea of accountability will become a part of Asian healthcare. The healthcare industry has always lagged behind other industries when it comes to IT adoption beyond what is considered bare-minimum. However, as the consumer takes on a new significance in the industry, and while stakeholders like the payer and the life science industry become active participants, the healthcare IT executives will widen their nets and learn from best practices in other industries. As in the United States and in Western Europe, approaches like lean and six sigma will be increasingly used in hospital operations, such as medicine supply chain management, asset management, revenue management, patient throughput and ancillary department management.

Ultimately, clinical analytics in a much broader sense, including population management and predictive analytics, will find a way into the region, as governments collaborate to combat infectious disease outbreaks.

Ultimately, 3rd Platform technologies will come together to create greater efficiencies for provider organisations.

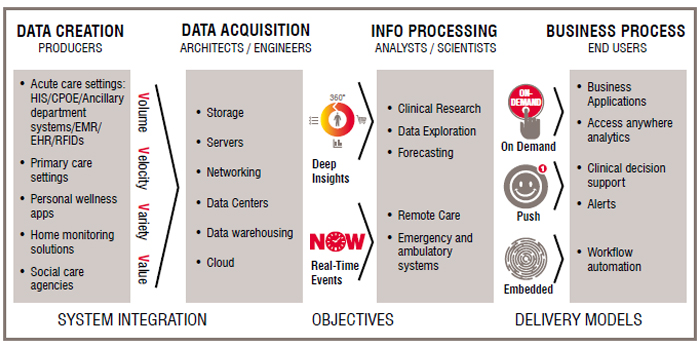

Healthcare is a data-intensive industry. Data is created by multiple sources, including administration systems, clinical solutions, and increasingly from mobile devices used for clinical mobility. Cloud solutions will become popular as the amount of data created increases exponentially. As the data and image archives continue to grow, and requirements for data retention force healthcare organisations to keep patient data for longer periods of time. And thus managing, protecting, discovering, and retrieving data are becoming challenging for storage administrators. However, ultimately, the value of all the data lies in converting it into information that the organisations can leverage to fulfil their business objectives. The information can be used for generating real-time dashboard views on current consumption as well as for deep insights on departmental and organisational financial performance, operational efficiency and clinical outcomes. Various roles in the organisation may need to access this information in different ways. While the management may request the on-demand information, several clinical roles will require the information on push functionality, like clinical decision support solutions. In advanced organisations, this analytics-based information may be embedded in the systems, for better workflow and automation in areas like inventory management.

Think 'Change Management' not 'Ad hoc’: The drive for adoption of newer technologies often comes from multiple stakeholders in healthcare, including Lines of Business (LOBs) and the C-Suite, while the ultimate task of implementing the projects lies with the IT department and the CIO. Emerging technology implementation projects require careful evaluation of the infrastructure, workflows as well as ROI considerations. Many organisations are too focused on ad-hoc implementations and not on the change management as what is required. The projects need deeper considerations like defining the business requirements, agreeing on the success metrics, finding executive sponsors, workflow and business process changes, risk and compliance considerations, and possible project scope changes.

Empower your IT: The IT skills required for running a successful organisation are no longer limited to network operations, technical support for applications and hardware, and help desk management. Many of these functions will be increasingly outsourced as IT becomes aligned with business. More and more organisations will need business intelligence and analytics, security, IT management, enterprise architecture and mobile development skills.

Focus on the consumers: Improving patient satisfaction has evolved as the key business driver for healthcare organisations. As technology develops and Internet access spreads, so does the role of the patients. Providers are no longer sole decision-makers in healthcare provision. Patients today are more informed than ever and actively participate in their health decision-making processes, influencing demand for healthcare services more than ever before, as they actively determine the quality of care they receive. This new generation of IT-empowered patients has high expectations for care, including expectations for advanced technology-enabled services.

The healthcare industry is at a disruptive stage globally. All countries around the world are facing new challenges around sustainability and accountability of their healthcare systems, which are more or less the same. While legacy systems and prior IT investments may prove to be large obstacles for mature economies, the slower development in emerging markets and the availability of newer technologies may well open up a shortcut for those countries to eventually achieve their own goals on sustainability and accountability.