For those who follow news in the healthcare IT world, not too many days pass without some mention of a health information exchange (HIE) being formed, whether through a government-backed initiative or a private venture. A lot of attention (and money) is being given to the area, but how much real progress has been made? How far have HIE vendors moved past flashy press releases into actual data exchange?

Each year KLAS Enterprises reaches out to healthcare providers in order to collect provider feedback on a variety of healthcare IT vendors and subjects. For the past two years, one of KLAS’s most anticipated reports has been the annual Health Information Exchanges (HIE) report.

This year KLAS interviewed 239 providers involved with 228 live HIEs to find out where North America’s HIE market stands today. The below article is an adaptation of the text presented in KLAS’s 2011 HIE report, Health Information Exchanges: Rapid Growth and Evolving Market.

For the purposes of this study, KLAS defined an HIE as at least two healthcare provider organisations actively exchanging (unidirectionally or bidirectionally) patient data and other information. Participating organisations can be any combination of acute and ambulatory facilities. Information must be shared between non-owned facilities, meaning the organizations are part of separate organizations. HIEs that are not yet actively exchanging data are not counted as live for the purposes of this study. Sites with point-to-point interfacing within a single IDN or other type of multi-facility system are not included in this study.

Still a Mile Wide, But Slowly Getting Deeper...

In the 2010 KLAS HIE Performance study, Health Information Exchanges: The Reality of HIE Adoption, KLAS discovered that the HIE market was “a mile wide and an inch deep,” meaning there were too many vendors to count but few actual live exchanges. In this year’s study, KLAS found that the market has matured and a number of vendors are beginning to stand out, but most HIEs still have a long way to go before they start making the positive impact on healthcare that providers and regulators are hoping for.

As governments and providers move forward with HIE plans, the number of live HIEs continues to increase. This year KLAS validated 228 live HIEs, up from 89 in last year’s study. The interesting discovery, however, was not the overall growth but where that growth was concentrated. The number of live public HIEs increased from 37 last year to 67 this year, while the number of live private HIEs grew from 52 last year to 161 this year. Why are private HIEs seeing such explosive growth compared to public HIEs?

Provider comments point to three main reasons:

Providers at both public and private HIEs mentioned that the key to future viability will be creating value for providers. If providers see real value in the services an HIE offers, they will have no problem paying for it. However, if HIEs have no tangible benefits to offer, provider subscribers will be hard to come by. One executive director described his thinking this way: “We are not charging [providers] right now. I cannot promise it will always be that way. If we need to go ask for funds [from providers], our objective is to make sure that we are demonstrating value at that point, and significant value, at that, so that it becomes kind of a no-brainer.”

Getting physicians on board

When KLAS asked providers how they measured the success of their HIEs, 37 per cent said they measure it by the number of physicians that actually use the data. Getting physicians to use the data is often easier said than done, especially when it slows them down. One provider related, “The doctors were interested in this to start out, but once they realised that they were going to have to do things in two different places, they lost interest. It is just too cumbersome.” With that challenge in mind, more HIEs are striving for ways to deliver useful data to physicians without requiring them to leave their normal workflow, but so far progress has been slow. In the 2010 study, KLAS found that 37 per cent of live HIEs were delivering data to physicians directly through their EMRs. This year, that number climbed to 43 per cent. If the providers that are running HIEs feel that physician adoption is so critical, why is that number not higher?

When KLAS asked providers how they measured the success of their HIEs, 37 per cent said they measure it by the number of physicians that actually use the data. Getting physicians to use the data is often easier said than done, especially when it slows them down. One provider related, “The doctors were interested in this to start out, but once they realised that they were going to have to do things in two different places, they lost interest. It is just too cumbersome.” With that challenge in mind, more HIEs are striving for ways to deliver useful data to physicians without requiring them to leave their normal workflow, but so far progress has been slow. In the 2010 study, KLAS found that 37 per cent of live HIEs were delivering data to physicians directly through their EMRs. This year, that number climbed to 43 per cent. If the providers that are running HIEs feel that physician adoption is so critical, why is that number not higher?

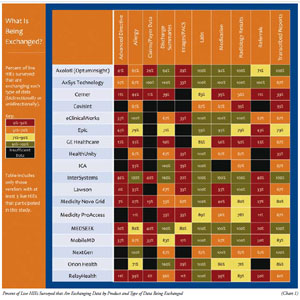

The chart displays the percentage of data being exchanged by live HIEs in various healthcare areas—listed by the product employed and the type of data that is being exchanged—for example, 41 per cent of live Axolotl customers are exchanging Advance Directive information.

Respondents described a number of barriers standing in the way of more direct interfaces into physicians’ EMRs. The first, and perhaps largest, barrier is the cost of the interfaces. Providers complained that EMR vendors charge an unreasonably high amount for interfaces, leaving both clinics and HIEs either unable or unwilling to pay for them. One CIO of a large health system commented, “When I look at the hundreds of providers that are using [our HIE] and the cost of getting those interfaces to their EMRs up, I wonder how we can possibly afford to interface everyone.”

Another challenge for HIEs looking to interface into EMRs is that, despite the surge in adoption created by the American Recovery and Reinvestment Act (ARRA) in the US, many clinics have yet to install an EMR, making an interface impossible for the time being. In addition, many clinics that have EMRs are hesitant to allow an HIE to push data directly into the EMR because of concerns over data integrity. Some clinics want only certain types of data to be pushed in, while others want to keep HIE data completely separated from their own records. One executive explained, “One interesting thing we are finding is that even though [our HIE] has the capability to move the virtual patient record to populate another system, most of the community physicians are opposed to that. They aren’t opposed to lab results or radiology reports, but they are opposed to the diagnoses. Their argument is that they are notsure they trust the information coming in, so they don’t want the diagnoses automatically populating their EMRs.”

Delivering the data: HL7 is still king

Although many of the providers KLAS spoke with plan to eventually exchange data using Continuity of Care Document (CCD) or Continuity of Care Record (CCR) formats, the reality today is that most HIEs have not yet been able to execute those plans. In the 228 HIEs KLAS validated for this study, 81 per cent of the data was still being exchanged through basic HL7 interfaces, while only 12 per cent was being exchanged using CCD/CCR. Providers generally ascribed this to a lag in technology. While some systems can create CCDs or CCRs, many are not equipped to send them, and still more are not equipped to receive them.

Even in the organisations that are successfully exchanging CCDs, some providers reported that the CCD is too much information for physicians to search through, indicating that it needs to be further refined so that doctors can quickly find the information they need. One executive said, “I know the CCD is this great document that everyone is expecting to get, but it is very cumbersome for those who have patients who are frequent fliers. In our state, people take recommendations from family and friends and shop around for their care. They may go have a test done at one place, their outpatient service done at another, and their surgery at still another. We want to be able to tie all that information together and see everything the patient wants us to.” The provider continued, “The CCD for that data can be very large. A patient who has diabetes, an orthopaedic issue, and an ophthalmology issue and who has had several surgeries will have a very big CCD. A doctor doesn’t want to see all of that. It is too overwhelming and time consuming.”

Payers entering the HIE mix: provider thoughts

As part of this study, KLAS asked providers for their thoughts on the recent acquisitions of Axolotl and Medicity by UnitedHealth Group and Aetna, respectively. Respondents had mixed feelings on the issue; 33 per cent felt the acquisitions are something to be concerned about, 28 per cent felt the acquisitions are a positive thing for the industry, and 39 per cent either had no opinion or felt the acquisitions will not have a major impact on the market.

The providers who were more optimistic felt that the acquisitions will give the HIE vendors more resources to develop and improve their products. They also believe that better access to the patient data will allow payers to find ways to improve the quality of care and decrease the cost. One CMIO gave the following example: “To me, the purchasing of HIE companies is probably a push for these payers to get patient data so that we can better manage waste. The big problem today is cultural. A patient with a mild head injury gets a CT scan by default that gets paid for by the payer. And yet 90 per cent of CT scans are not turning anything up. So the data would help determine where CT scans are necessary and where they are not.”

The providers that were concerned about the acquisitions were mostly worried about how Aetna and UnitedHealth will use the patient data that they will now have access to. These respondents fear the data will be used to deny coverage to patients and to exercise more control over providers. One provider described his reasoning like this: “If payers want to pay for the HIE because they think it will provide better care, I am all for that. However, I don't know how we can ensure that they will not notice that a patient has AIDS, for example, and refuse to cover that patient. If I were [an insurance company’s] customer and I heard [them] say they were going to take my data and throw it into a big database, I would wonder what the heck they plan on doing with it.”

Interestingly, Axolotl and Medicity customers were not any more pleased with or concerned about the acquisitions than the rest of the provider population; of those Axolotl and Medicity customers that participated in this study, 47 per cent felt the acquisitions were a positive step and 32 per cent expressed concern.

Here to stay

While the HIE market has made substantial progress in the past year, it is clearly still in the early stages. The majority of HIEs are still building the foundation for what they hope will become robust and meaningful exchanges in the future.

Moving forward, accountable care organisations, other pay-for-performance models, and future government requirements will all continue to increase the pressure on provider organizations to make patient data accessible across the continuum of care. Trial and error among HIEs already in existence, as well as HIE-related initiatives slated for the future will continue to shed light on what works and what doesn’t work when it comes to information exchange.

If nothing else, the events and developments of the past year seem to have established one thing: HIEs are not going away. As both the US and international healthcare markets continue to evolve, HIEs will likely only increase in importance.

Author BIO

Jason Hess is responsible for all clinical research collected at KLAS. Jason works with hundreds of CIOs, healthcare providers, and vendor executives in monitoring the performance of Healthcare IT. His expertise include: Health Information Exchanges, Core Clinical, Emergency Department, Pharmacy, Surgery Management, Pharmacy, Lab, Pharmacy Automation, among other research areas.

Mark Allphin has spent several years in the software/IT industry both from a sales and a research analyst perspective. He currently works for KLAS Research and oversees several market segments, including HIE, Lab, Surgery, Anesthesia, Critical Care, Medical Device Connectivity and Interactive patient systems.