Asian healthcare is the new centre of gravity with the global healthcare growth. Growth is primarily driven by robust fundamentals such as large, rapidly growing ageing population, increasing affluence, rising middle-class and increasing incidence of chronic diseases. However, a large demand-supply gap and low public spending on healthcare has created challenging operating healthcare landscape. Many of the economies in Southeast Asia are struggling with a relatively underdeveloped healthcare system. As we look beyond the current into the future, we find that the impending systemic changes in the system, supported by investor friendly policies and collaborations, would be needed to create a stronger healthcare ecosystem.

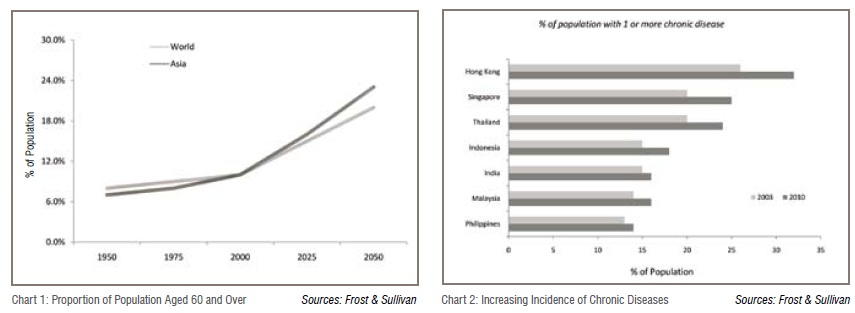

The healthcare delivery market in Southeast Asia, valued at US$71 billion, remains significantly under-penetrated and underprepared. This is reflected in the high growth rate of 15 per cent, clocked year-on-year. The region accounts for 10 per cent of the world’s population and 20 per cent of the world’s disease burden, yet commands only 3 per cent of global healthcare expenditure. As the region ages (Chart 1) and becomes more urbanised and more affluent leading to life style changes, the incidence of chronic diseases (Chart 2) will increase. The incidence of chronic diseases is expected to double from 2001 to 2025. This in turn will create increasing demand for good quality healthcare delivery facilities and infrastructure.

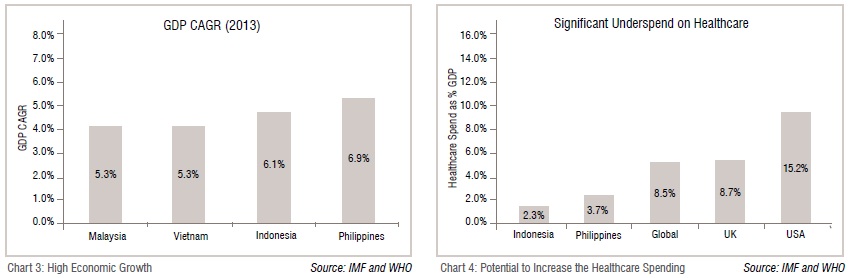

The region, especially Indonesia and the Philippines, is expected to exhibit strong growth in the period 2014-18 (Chart 3) on account of strong domestic demand, high infrastructure spending and execution of structural economic reforms. This in turn would result in an increase in disposable income and hence create further need for healthcare services at all levels.

While on one side, the demand is expected to grow multi-fold, the supply side situation does not look encouraging. Healthcare infrastructure in the region, to say the least, remains severely undersupplied and underdeveloped, with the gap expected to widen. Average healthcare expenditure as a per cent of GDP in the region, for instance 2.3 per cent in Indonesia and 3.7 per cent in the Philippines, significantly trails that of developed nations (Chart 4). In absolute terms, Indonesia and the Philippines spend only US$91 (PPP) and US$129 (PPP) per capita on healthcare respectively versus the global and US average of US$899 (PPP) and US$7,164 respectively.

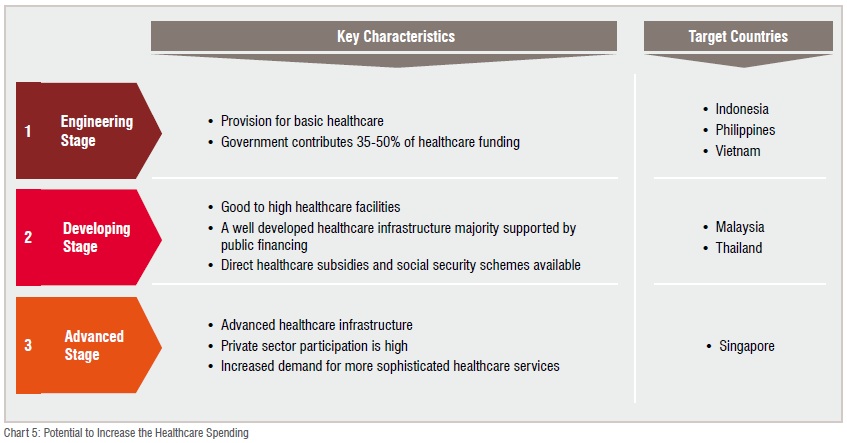

Low healthcare spend by governments in the region has further resulted in healthcare systems that are often ageing, under-developed and overstretched. For instance, there are only nine hospital beds per 10,000 population in Indonesia and 10 hospital beds per 10,000 population in Philippines as compared to the global average of 30 beds per 10,000 population and OECD average of 50 beds per 10,000 population. Governments are now trying to meet this demand. Indonesia, for example, has decided to implement universal healthcare at national level; where previously more than 125 million (more than half the population) lacked access to state health coverage, state or private health insurance. However, the efforts still fall short of narrowing the demand-supply gap and as a result, the healthcare market in the region varies in structure and maturity (Chart 5).

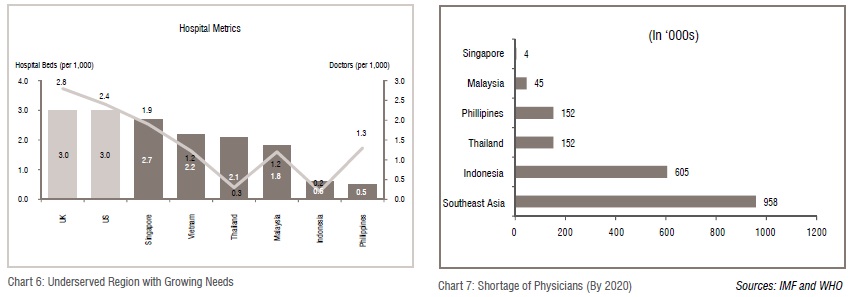

The human resources aspect of supply looks equally discouraging. The overall healthcare talent canvas has massive gaps, with several critical talent pools virtually non-existent. The health education system in the region is ill prepared to produce adequate talent of reasonable quality. There is significant challenge in building the core pool of doctors, which is a cause for alarm. Indonesia, for example, has only 4 doctors per 10,000 people, lower than the global average of 14 doctors per 10,000 people (Chart 6 and 7).

Consequently, governments in Southeast Asia seek to attract private capital into healthcare systems to increase the access and affordability of healthcare services in the region, develop efficient healthcare systems and meet the increasing capital requirements for new and upgraded systems. In most Southeast Asian countries, the share of private healthcare expenditure is higher than that of public expenditure. Furthermore, due to growing healthcare costs and significant portion (more than 60 per cent) of the expenditure financed out of pocket, the calling is for the government to rise up and address the supply side of healthcare eco-system.

Whilst most industries develop products and services keeping customer at the centre of everything, healthcare, traditionally, has been paternalistic in nature. However, with changing nature of medicine, growing patient awareness and increasing spread of the internet, the scenario is changing. Patients are becoming more informed about their health profile and are devoting time, money, energy to stay healthy. Patients today are demanding uniform access to preventive and curative care at a given level of cost. Many countries are struggling to address increasing costs, poor or inconsistent quality and inaccessibility to timely care. Attempting to resolve these issues is daunting. And many believe the only cure is a fundamental transformation of healthcare. To be able to cater for tomorrow’s healthcare demand, proper planning needs to be done. I believe that there are four areas, where both governments and private organizations would need to focus on to be able to cope up with the demand.

Whilst most industries develop products and services keeping customer at the centre of everything, healthcare, traditionally, has been paternalistic in nature. However, with changing nature of medicine, growing patient awareness and increasing spread of the internet, the scenario is changing. Patients are becoming more informed about their health profile and are devoting time, money, energy to stay healthy. Patients today are demanding uniform access to preventive and curative care at a given level of cost. Many countries are struggling to address increasing costs, poor or inconsistent quality and inaccessibility to timely care. Attempting to resolve these issues is daunting. And many believe the only cure is a fundamental transformation of healthcare. To be able to cater for tomorrow’s healthcare demand, proper planning needs to be done. I believe that there are four areas, where both governments and private organizations would need to focus on to be able to cope up with the demand.

i. Infrastructure planning:

Infrastructure forms a critical part of healthcare delivery in any country. Availability, accessibility, affordability, equity, efficiency and quality services highly depend on the distribution, functionality and quality of infrastructure. In most part of the region, the healthcare infrastructure has large gaps and inadequacies, both quantitatively and qualitatively. Since, over the last few years, the growth in healthcare infrastructure has been driven by private organisations, the focus has been on generating returns rather than increasing accessibility and affordability. Consequently, most of the health systems are focused on advanced secondary care/tertiary care services in metro and tier 1 cities. Furthermore, due to lack of focus by the government, the existing public facilities have deteriorated over time reating a huge undersupply of quality public health systems in the region.

To be able to narrow the infrastructure gap, a holistic approach needs to be taken. The focus needs to shift from construction alone to ensuring that infrastructure is well integrated in health systems, managed efficiently, and operated at high quality. In addition to increasing the traditional health models, such as primary health clinics, secondary and tertiary care hospitals, organisations would need to develop other delivery care structures, such as ambulatory care centres, single specialities clinics and home-based care.

These emerging delivery care structures can help free up capacity from income-generating assets in hospital and as a result make the entire ecosystem more effective and efficient. Furthermore, the ability to differentiate their services and focus on a few select specialities helps these models to be operationally efficient, economical and capable of generating higher return compared to traditional health systems. A ‘factory-approach’ mind-set allows them to focus on creating operating protocols that help deliver affordable quality care. Also, as these centres are asset-light models, it enables them to scale up faster and reach out to a larger population across rural areas / small town / tier 2 cities.

The last component of healthcare infrastructure, where governments and private organisations would need to work together is to strengthen the medical education system in the region. There is a need to be a focus on increasing the number of quality medical institutes to tackle the issue of supply constraint of clinical staff.

ii. Collaboration across the value chain:

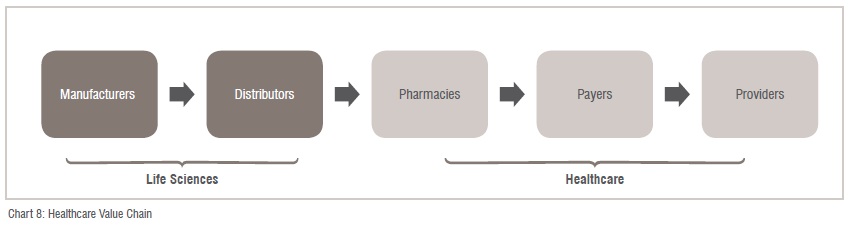

Currently the entire healthcare value chain is going through different stages of evolution across the regions. For instance, the gloves manufacturing industry in Malaysia is one of the largest in the world, while the healthcare delivery market in Thailand has some of the largest healthcare chains in the region. However, in most countries, some part of the value chain (Chart 8) is either underdeveloped or constrained segregation in silos.

To help strengthen the healthcare delivery segment, governments in the region would need to take a holistic approach and focus on collaboration of all the components of the value chain. Pharmaceutical manufacturers and medical device companies will play a greater role, as they did in other geographies, by increasing healthcare access, better experience for patients, improving clinical outcomes, and reducing the total cost of care.

For instance, the pharmaceutical industry in India is highly sophisticated and developed. Most of the Indian companies supply medicines across the world and have tie ups with large MNCs. Additionally, the cost of developing medicines in India is minimal when compared to many countries. This has resulted in increased access to affordable critical medicines for the masses. Similar focus of developing the indigenous pharmaceutical markets, in Southeast Asia is necessitated.

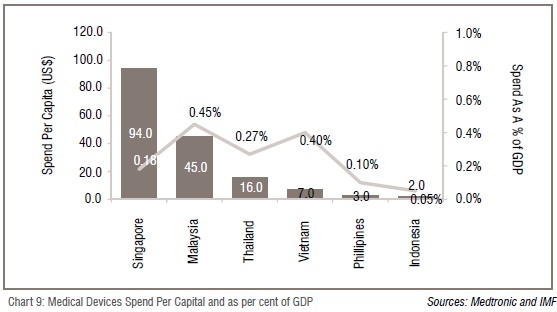

On the other hand, development of the medical devices industry would help in early detection and better outcomes at a lower cost. Increase in local manufacturing of these devices could lead to opportunities to introduce low cost solutions and devices. Currently, the access to medical devices is highly variable in the region (Chart 9)

iii. Use of IT:

IT offers a huge potential to revolutionise healthcare by making it more responsive to consumers’ needs, and being convenient for patients to access, and efficient and satisfying for providers to deliver. As different countries are trying to re-structure delivery model and promote efficient use of resources, a clear trend is pointing towards technology-enabled healthcare as means to revolutionise the way people receive and manage care. Healthcare systems would need to leverage technology to cater to the demand and need of healthcare services

Until now, IT was applied more to support the non-clinical functions such as accounting, procurement, human resources, admission, discharges, etc. However, the providers are now increasing the application of IT across various functions, including clinical functions, due to its ability to save costs as well as improve the quality of clinical care.

IT-enabled healthcare services will see growing use in areas such as Electronic Health Records (EHRs) and Computerised Physician Order Entry (CPOE) that help reduce medical errors by mapping patient history with current prescriptions. These technologies also assist the physician in reviewing the patient’s medical history and accurately diagnose the condition. As a result, application in ancillary activities such as scheduling for doctors, staff, equipment and assets will transition to an online system which will allow administrators to analyse various trends and as a result minimise wastage of resources and optimise labour.

Most of these technologies don’t require significant changes to work-flow for the hospitals, apart from building a comprehensive patient management system. e-ICU, a concept that is growing particularly in India and could be exported to this region, is one of the many examples of leveraging clinical expertise, processes and high-end technology for the benefit of the hospital as well as patients. In a country like India, that has more than 5 million ICU admissions every year, there are only approximately 5000 critical care physicians. An e-ICU is aimed at taking adequate critical care to patients at peripheral systems and minimising patient dislocation and disruption. The e-ICU can also train staff at peripheral care centres to treat critical patients in real-time and thereby improve critical care delivery. With most of the technology and manpower requirements standardised, an e-ICU spoke centre can be set up in less than three weeks; hence, minimises the disruption of hospital operations.

IT will also play a significant role in transforming the mind-set to view health more from proactive measures rather than reactive measures. Growing usage of smartphones and increased access to internet is allowing patients to stay informed, monitor and manage various conditions on a regular basis from home at their convenience and view health as a general wellness. As a result, an increase in the number of remote monitoring services as well as bio-sensing devices will take place, which will help in optimising the care coordination and patient engagement channels.

iv. Robust payer model:

Out-of-pocket expenditures have increased significantly in the region, reaching as high as 85 per cent1 of total health expenditures in Vietnam and 80 per cent2 of total health expenditures in Malaysia. This compares very differently to the developed markets, where the out-of-pocket expenditures account for less than 35 per cent2 of total health expenditures.

Healthcare insurance in the region has remained highly underdeveloped and less significant segment, reflecting the overall stage of development of healthcare systems. However, with increase in affluence, increase in chronic diseases, improvements in healthcare systems and increase in medical costs, the demand for healthcare insurance is expected to rise significantly.

Overall, the private health insurance market remains highly fragmented in Southeast Asia, with over 30 licensed insurers among the life and general insurance companies in Malaysia, 40 in Singapore and over 75 in Thailand. In comparison, the mature markets are more consolidated, with the ten biggest players accounting for close to 80 per cent of the total premium. In order to capture a higher market share, insurance companies should be flexible in designing products as per the need of the customers and making the reimbursement mechanism more convenient. Also, based on changing needs and awareness of the consumers, product offerings should evolve from basic standalone policies to integrated packaged polices covering hospitalisation cost coverage, as well as products for maintaining general wellness for various types of family construct.

As a result, the healthcare insurance model will have to evolve to create strong synergies between private and public players, complementing each other’s service offerings. A focused approach encompassing public and private sectors and leveraging emerging technology will play a disruptive role in the healthcare transformation ahead. I believe that the transformation will be built on increased spread of government-driven universal healthcare delivery and financing model, augmented by private healthcare insurance ensuring access, cost and quality with patient centric focus.

As a result, the healthcare insurance model will have to evolve to create strong synergies between private and public players, complementing each other’s service offerings. A focused approach encompassing public and private sectors and leveraging emerging technology will play a disruptive role in the healthcare transformation ahead. I believe that the transformation will be built on increased spread of government-driven universal healthcare delivery and financing model, augmented by private healthcare insurance ensuring access, cost and quality with patient centric focus.

The private insurers will need to develop processes for identifying and on-boarding patients, to correctly estimate the risk profile and subsequently develop a strong and underwriting process to the exact needs of different population segments.

Role of Governments and Private Organisations in Healthcare Management:

As we can see, different stakeholders to get together to create a robust healthcare ecosystem, and it includes the government, private sector, multilateral organisations, charities, and social enterprises. As the region continues on its path to development, each of these stakeholders would play a key role and function to create a sustainable healthcare environment in the region. To strengthen the ecosystem, there should be a clear demarcation of roles between providers of healthcare system and financiers for healthcare systems. This need emerges from the fact that no one type of operator can manage things alone, and both public and private organisations would need to collaborate. Collaboration between public and private organisations could be on infrastructure development in form of PPP or could be in the form of providing a specific service within public health system.

However, in general, the government is best placed to act as regulator and financier of health services, with providers coming from the private sector.

First, the government should be responsible for providing healthcare systems to the vulnerable sections of the society. This would include both providing for infrastructure, in terms of establishing primary and secondary care clinics, as well as financing the cost of treatment. Secondly, the government should also work towards ensuring that the ecosystem has adequate number of skilled clinical staff. This would require them to establish more medical institutes and ensure that the quality of clinical staff is maintained. Lastly, the government should create an ecosystem to attract and enable the growth of private organisations.

On the other hand, private organisations should focus on providing advanced healthcare services for middle income and high income groups, and the manufacture and distribution of medical equipment, supplies and pharmaceuticals. A business-like approach would be critical. Private organisations would need to re-design their approach with an aim to keep patient attention and build value.

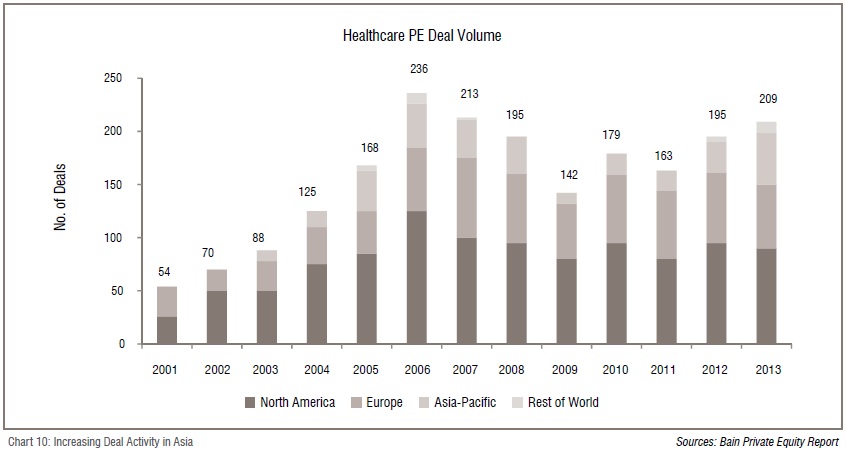

Alongside large demand characteristics, the external factors such as improving economy and stable government in most parts of the region are helping attract private investors and resulting in an increase in the deal activity (Chart 10).

Governments across the regions are trying to deregulate most of the services and also offer tax incentives for players to develop healthcare infrastructure (including pharmaceuticals and medical devices). Due to the cost advantage offered in the region, it is also witnessing a large influx of medical tourism patients. Additionally, the need for growth capital among healthcare start-ups is expected to push the number of transactions in the healthcare space.

Southeast Asian countries are facing double burden characteristics of a developed country, i.e. of increasing ageing population and incidence of chronic diseases. However, the economies haven’t developed to a level comparable to the developed countries. This is leading to increased healthcare challenges of delivering affordable quality care to the masses.

Solving these issues demands innovation: to manage healthcare in different ways, more efficiently, with better quality and affordable cost. It would be naïve to think of innovation to being limited only about new drugs and better machines.

However, innovation would entail a collaboration of differentiated ideas applied to business models for delivering healthcare services, to regulation, to financing, to leveraging technology and to the nature of partnerships between different types of healthcare organisations, be they private companies or government organisations.

1&2 Source World Bank (Developed markets include US and UK)